Layering Life Insurance Policies for Big Savings

Layering Life Insurance Policies for Big Savings

A great way to save money on your life insurance coverage is to layer your policies. Layering your life insurance policies could save you thousands over the life of your coverage. The strategy is pretty simple. In most cases, your need for life insurance diminishes as you get older. By layering your policies, you can structure your coverage so that it decreases as your need for life insurance decreases. This is done by purchasing multiple policies with different durations. This strategy can offer substantial savings compared to buying one long-term policy. But before you consider layering your life insurance coverage, we want you to know all of the facts. This post will discuss how to layer coverage and the benefits and drawbacks to doing so.

How Does Policy Layering Work?

Let’s take a look at a scenario when layering life insurance coverage might make sense. Let’s say you are 35 years old and you have determined that you need $1,500,000 of life insurance. You have 2 children, ages 4 and 6, and would like to provide college funding for them in the event you pass away prematurely. You would also like to cover your existing mortgage balance of $250,000 that has 20 years remaining on it. You plan on working until your 65 years old and would like coverage to replace your income if you were to pass away prematurely. Looking at this scenario, you would have a couple of options for insurance coverage.

Purchasing One Policy

You could purchase a 30 year policy for $1,500,000 of coverage. Assuming your health class rating was ‘Preferred’, you would pay $1,468.91 annually for 30 years of coverage. This would cost you $44,067.30 over the life of your policy. This would cover all of your obligations for the full 30 years. The potential drawback to this approach is that you could be over insuring yourself in the latter years of coverage when your home is paid off and your children are no longer dependents.

Layering Life Insurance Coverage

Instead of purchasing one 30 year policy, you could layer a couple of policies with different durations. At ages 4 and 6, your children represent an insurable need that will most likely last for the next 20 years. In 20 years, they should be at a point where they are no longer financially dependent on you. Your mortgage will also be paid off in 20 years as well. You could buy a 20 year policy for $1,000,000 coverage and a 30 year policy for $500,000 coverage. This would provide $1,500,000 of coverage for 20 years when you are most financially vulnerable. In 20 years, when your children are dependent and your home is paid off, the 20 year policy would expire. You would still have $500,000 of coverage for 10 more years until you retire. The 20 year policy for $1,000,000 of coverage would cost you $616.37 annually for a total of $12,327.40 over the life of the policy. The 30 year policy for $500,000 of coverage would cost you $545.82 annually for a total of $16,374.60 over the life of the policy. Layering your coverage as opposed to buying one long-term policy would save you $15,365.30.

Purchasing One Policy

| Duration | Coverage Amount | Annual Premium | Total Paid |

|---|---|---|---|

| 30 Years | $1,500,000 | $1,468.91 | $44,067.30 |

Layering Policies

| Duration | Coverage Amount | Annual Premium | Total Paid |

|---|---|---|---|

| 20 Years | $1,000,000 | $616.37 | $12,327.40 |

| 30 Years | $500,000 | $545.82 | $16,374.60 |

| Total Cost of Both Policies | $28,702.00 |

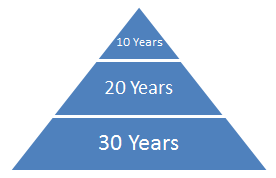

This is just one example of how you could layer your coverage. Still using this example, you could save even more by purchasing three $500,000 policies with durations of 10, 20, and 30 years. You could also use a layering strategy that includes a small permanent policy that could be used to pay final expenses. The key is to have your agent show you multiple options so you can make the decision that works best for your situation.

What to Consider Before Layering Life Insurance Coverage

You now know how layering your life insurance coverage can lead to big savings over the life of your policy. That’s the good news. But before you consider layering your life insurance coverage, it is important to understand the potential drawbacks to using the strategy.

Life Doesn’t Always Go According to Plan – Your life insurance needs might not diminish as quickly as you expect. You might decide to have another child, buy a larger home or you could experience some other unexpected financial obligation. Layering your coverage could leave you financially vulnerable if your shorter duration coverage expires when you still need it. What could make this scenario even worse is if you develop health issues. Having to apply for additional coverage might be cost prohibitive. The safety of locking in one long-term policy for the full amount of coverage might offer more security than layering coverage.

Inflation Can Reduce Value of Coverage – The value of your coverage will diminish over time because of inflation. One million dollars of coverage is worth more today than it will be in 20 or 30 years from now. Losing any coverage by layering your policies could leave you underinsured.

Should You Layer Your Life Insurance Coverage?

If you are looking to save money on life insurance, layering your policies could save you thousands over the life of your coverage. As long as you understand the potential drawbacks, layering your coverage could be a worthwhile strategy. If you are interested in learning more about this strategy or would like us to show you some options, give us a call at (888) 687-9444 or email us at info@archstoneagency.com. We will shop over 40 of the top life insurance companies so that we can find the best fit for your situation.

About Us

Archstone Insurance Services, LLC is an independent agency that shops over 40 of the top life insurance carriers to provide huge savings on life insurance coverage for our clients. We are happy to answer any questions you might have about any of the insurance products we offer, your planning needs or your existing coverage. Feel free to call us directly at (888) 687-9444 or email us at info@archstoneagency.com.